You will be asked to confirm your identity by calling the number on the notice within 30 days. If the IRS spots a suspicious return filed with your SSN, they may send you a Letter 4883C. If the IRS rejects your return or you believe they wrongfully rejected the return, take action to notify the IRS about your potential identity theft as soon as possible. The IRS needs time to verify your identity and resolve your case. You may have to wait a lot longer than usual to receive your tax refund. You should not be held responsible for the fraudulent filing. If someone filed a return using your information without your signature or authorization, it is not a valid return. If you are a victim of tax-related identify theft, take the following steps: The IRS has a specialized team to handle these cases and get your issues resolved. Tax-related identity theft can be a frustrating experience. Other times, the fraudulent return may be accepted, and your return will be rejected when you attempt to e-file it. In some cases, the IRS may spot something unusual about the fraudulent return and send you a notice asking you to confirm your identity. Someone else can fraudulently use your SSN to file a tax return and attempt to get a tax refund. The IRS will not send unsolicited emails or call you threatening to send you to jail or sue you.Įven when you’re careful with your personal information, identity theft can still happen to you. Go to the websites of the companies directly. Don’t click on links or attachments in emails from people you don’t know. Don’t leave personal information in places where other people can access it.

Only give your personal information to companies you trust.

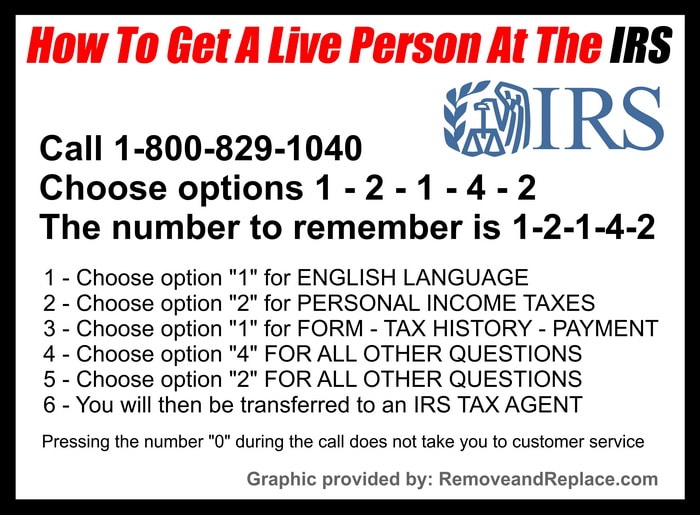

IRSS TAXES PHONE INSTALL

0 kommentar(er)

0 kommentar(er)